If you have a cell phone contract with one of the big four - AT&T, Sprint,

T-Mobile or Verizon - it's likely that your bill isn't as straightforward as you

might think. Cell phone bills from these popular carriers are riddled with taxes

and extra charges - and even worse, these charges are on the rise.

So, what exactly are all of these surcharges you're unwittingly paying, for?

Here's a quick breakdown of some of the extra fees you might find on your cell

phone bill, along with some tips for lowering them.

911/Emergency Response Fees

All cell phone carriers are responsible for helping local governments pay for emergency services such as fire and rescue. Most of them do so by charging each customer a bit extra every month. Some states mandate that the carrier charge a flat fee per telephone line, while others ask a percentage of revenue. While not all states ask that the carrier pass these charges to the customer, it's common practice that they do. Curious what charges your state enforces? The National Emergency Number Association provides a list of the state-by-state emergency services tax rate for cell phone users.

Universal Service Fund

The federal government requires that all cell phone providers contribute a percentage of their revenues to the Universal Service Fund (USF), which pays for low-income communication services. Carriers are not required to pass this expense along to their customers - in fact, many smaller cell phone providers absorb the cost - however, the big four carriers generally prefer to charge these fees to the user.

State Telecommunications Excise Surcharge (aka Gross Receipts Surcharge)

Many states, such as New York, New Mexico, and Pennsylvania, charge sales and excise taxes on communication services. As with the USF charges, the big four carriers will pass these taxes directly onto the customer. This fee usually comes in as a percentage of your bill and can add an extra 5 or 20 percent to your monthly payment depending on the state.

Local Taxes

Along with Telecommunications Excise charges, you'll also have to pay taxes for simply having a wireless service. How much varies depending on where you live. Each state, county, and city has a unique a tax rate on wireless service, and the rate can vary dramatically. Customers in New York state, for example, pay an average of 24.36% in federal, state and local taxes on their wireless bills. If you're moving, especially to a state with lower taxes, make sure to remind your carrier to update your bill.

Regulatory Charges

Oddly enough, the Regulatory Charges aren't actually government-mandated charges. In reality, your cell phone carrier uses these charges to cover their operating expenses for participating in government mandated programs, such as offering local number portability. And, you guessed it, they're charging you extra to make it all happen.

Administrative Charges

Administrative charges are potentially the most tricky to pin down, as the term is used to cover all sorts of evils. These charges are often put towards paying the fees other carriers impose on your cell phone provider for delivering calls, however, they might also be put towards network maintenance or other anonymous expenses. In 2013, AT&T announced that their administrative charges would go towards “charges associated with cell site rents and maintenance.” These fees can and do change frequently without prior warning.

Smartphone Access Line

Some carriers, such as Verizon, charge you extra simply for having a smartphone as your registered cell phone. Beyond what you pay for minutes, messages and data, Verizon's Smartphone Access Line fee charges from you up to an extra $20 a month simply for owning a smartphone.

Lowering Your Bill

According to the Tax Foundation, a consumer tax and spending think tank, the extra taxes on cell phone bills have increased by nearly 4.5% in the last 10 years to a shocking 18.6%. According to the foundation, the average American pays $225 a year just in taxes and fees on their wireless bills (that's beyond service charges).

Some of the above fees, such as the state and local taxes, you're stuck with. Although lawmakers have proposed bills that would curb or limit these taxes, nothing has been passed, meaning that at the moment, there's nothing to stop these taxes from rising.

Service fees are also going up, but there might be something you can do about those. Some people have reported success negotiating on their administrative costs, and if you've got the time, it's worth a go. Try talking to your customer service representative, or writing a letter to the CEO of your cell phone company about curbing the excessive charges.

Another option is to simply lower your bill. Most of these taxes surcharges are charged by percentages of your service bill, so by removing nonessential services and lowering that bill, you'll lower the taxes and fees as well. Market research firm NPD Group suggests starting by getting rid of your unlimited high-speed data, which according to their research, most people don't actually use.

"Check your own cell phone bill over the course of several months, find out your average data usage and, if you are using 5GB or less, stick with a fixed data amount plan that will most likely cost you less per month," explained cell phone expert Christine Gallup in an interview with CNBC. See Community Phone’s plans starting at $15/month!

If none of that seems to be working, it might be time to switch carriers. See our guide to switching carriers. Community Phone only charges Sales Surcharges, and USF - no administration fees or add ons. Check out our plans now!

Lower Your Cell Phone Bill With Community Phone

Community Phone is the best wireless phone service in the US, providing reliability and excellent voice quality at affordable prices. The company provides reliable cell phone, wireless landline, and business phone services at a low cost.

Community Phone has combined essential features and eliminated non-essential services to have cost-effective cell plans to cater to your needs and reduce your bill amount.

The company has partnered with nationwide carriers to provide coverage to 99% of the US, including rural areas. Experience excellent call quality and uninterrupted service when your Community Phone cell service switches seamlessly between 4G LTE and 5G, whichever is robust in your area.

Enjoy unlimited calls and texts with basic cell plans starting at $29, or pick from their other plans that include data to suit your needs. If you are an existing Community Phone landline customer, the company offers exciting discounts and bundles to help you economically manage more than one line.

Read on to learn more!

Community Phone’s Essential Cell Features

Unlimited Talk

Enjoy unlimited talk time to stay connected with your loved ones, colleagues, employees, or customers with Community Phone’s unlimited talk feature. Call anyone across the US personally or for business without fearing a massive long-distance bill.

Unlimited Text

Text messages are an excellent way to stay in touch when you cannot make or receive calls, are in a noisy location, or have a patchy service. Businesses also can benefit from this feature as customers prefer text messages over calls for fear of spam. Use the unlimited text feature to stay connected with your loved ones and share precious moments or business associates to collaborate effectively.

Premium Cell Features

These features are not a part of the cell plans and can be added to your existing plan to suit your needs.

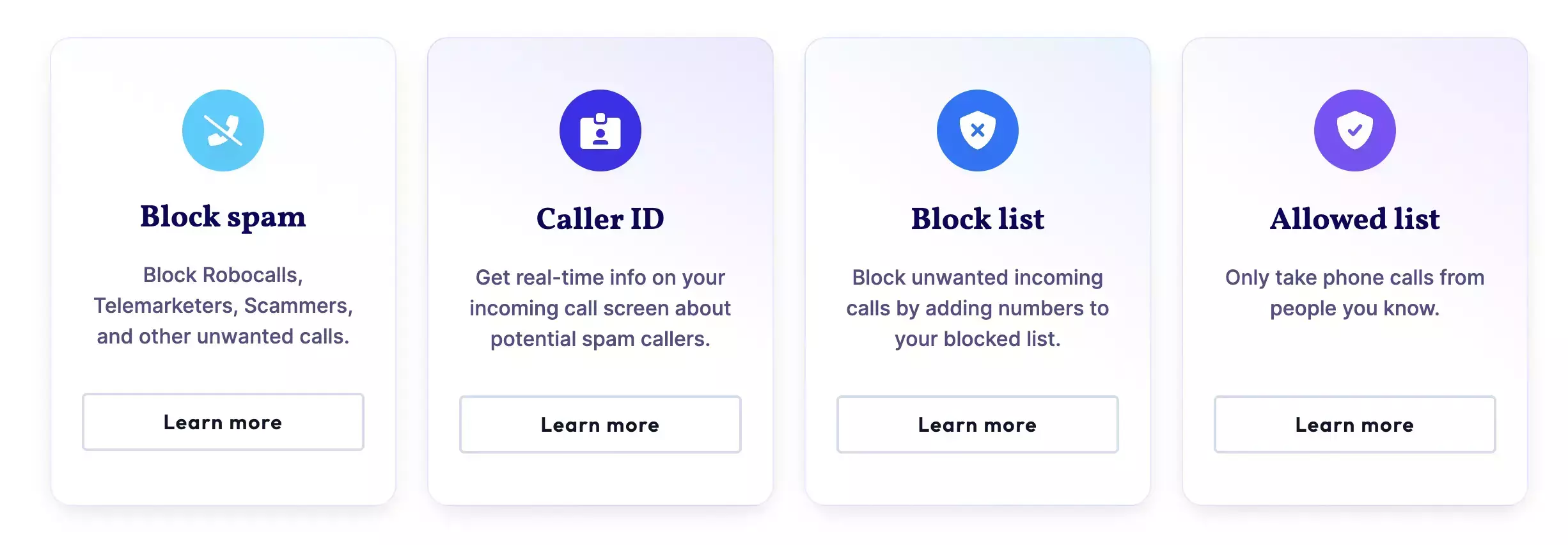

Spam Call Blocking

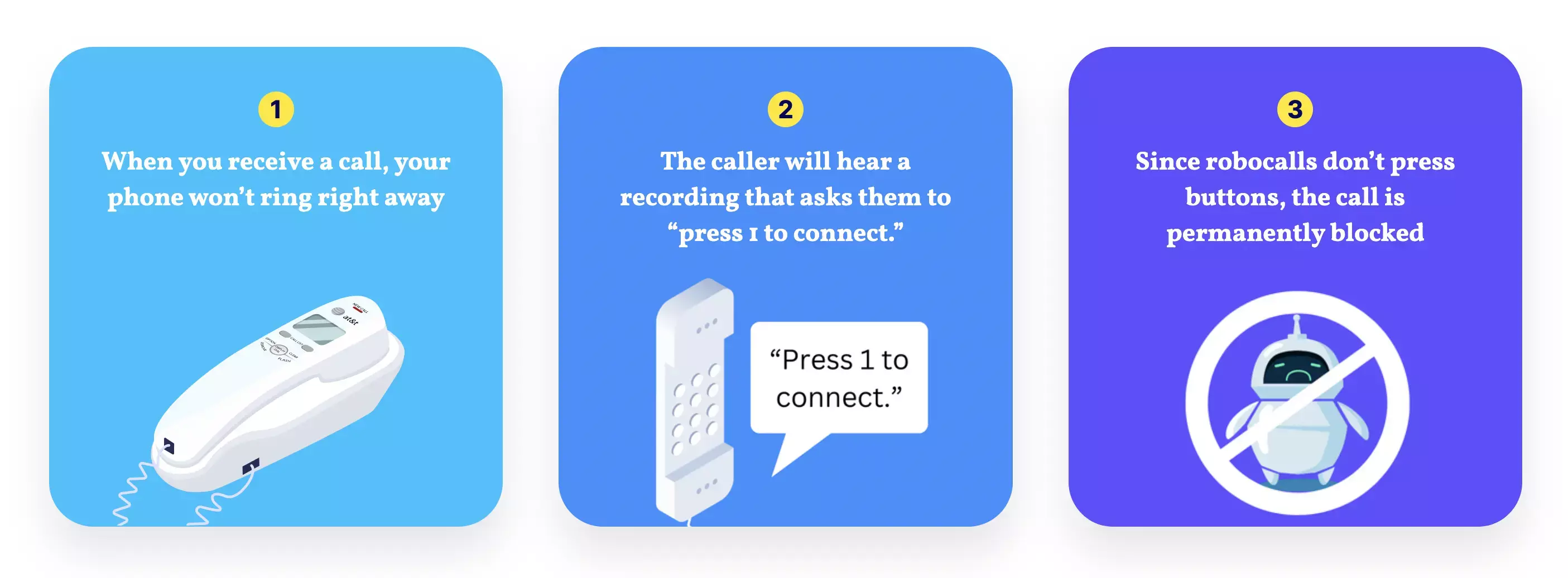

Incidents of spam calls on cell phones are on the rise as spammers relentlessly pursue their attacks to target gullible victims. 97% of Americans received a robocall in 2022, with only 3% not receiving them in the last 12 months. These spam calls are a waste of time and potentially dangerous, as the spammer may be looking to steal your data or mark you for further attacks.

Your best bet in such a scenario is Community Phone’s built-in spam call blocker that blocks millions of spam calls automatically before your phone rings. This robocall blocker challenges robocalls, flags them, and blocks them before your phone rings.

As spammers become more deceitful in finding ways to circumvent the STIR/SHAKEN protocol, Community Phone has been working hard to release iterations of the spam blocker to protect its customers. The Safelist option allows you to share the list of numbers from which you want to accept calls. Community Phone will allow these calls to ring your phone and block all other calls.

Statistics reveal that many people ignore legitimate calls for fear of engaging a scammer, causing loved ones to worry. An iteration of the Safelist is launching soon, allowing calls from your accepted list to ring your phone and route all other calls to your voicemail. You can respond to these voice messages only if you deem them necessary.

Soon-to-be-launched, the blocklist is a more aggressive spam blocker that blocks spam calls based on an ever-growing database of spam numbers and a spam score. You can contribute actively to the blocklist to protect yourself and other Community Phone members from scammers and frauds.

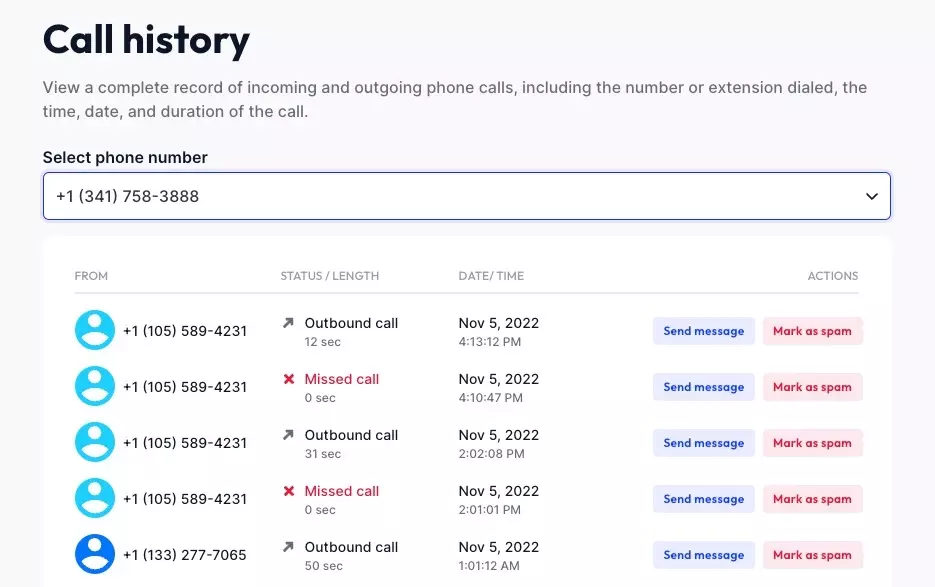

Call History

Enable the call history feature and access information on incoming and outgoing calls, the name of the caller, the extension number dialed, and the time and duration of the call.

You can use this feature to

1. Return missed calls from known contacts

2. Store legitimate contacts

3. Check caller information against known contacts

4. Send a message, or

5. Block spam numbers

Why Switch to Community Phone?

Here are some benefits when you join the Community Phone family:

1. 5G or 4G LTE: Your Community Phone cell service will switch between 5G and 4G LTE seamlessly, depending on whichever is the strongest in your area.

2. 24/7 reliable customer support: Contact Community Phone customer support via phone, email, and live chat 24/7 to experience world-class support from live agents. Glowing customer reviews on BBB and Trustpilot are testimonies of their customer commitment.

3. Affordable Plans: Community Phone has several plans starting from as low as $29/month. You can choose from the basic, Essential, Value, or Maximum plans to suit your individual or business needs.

4. No hidden charges: Community Phone only charges Sales Surcharges and USF - no administration fees or add-ons, helping you save considerably on your cell phone bill.

5. International calling: You can make international calls from the US at competitive and affordable rates compared to other providers. Check the Community Phone website to learn more!

Conclusion

While communication is an essential social necessity, paying an arm and a leg to stay connected with loved ones or work doesn’t sound like a great idea. Here are some ideas to bring your cell phone bill down.

Switching to Community Phone is the best way to reduce your phone bill. Their cell phone service is the best for you, with essential features bundled at affordable prices.